Ethereum Price Prediction: Will ETH Reach $5,000 Amid Institutional Frenzy?

#ETH

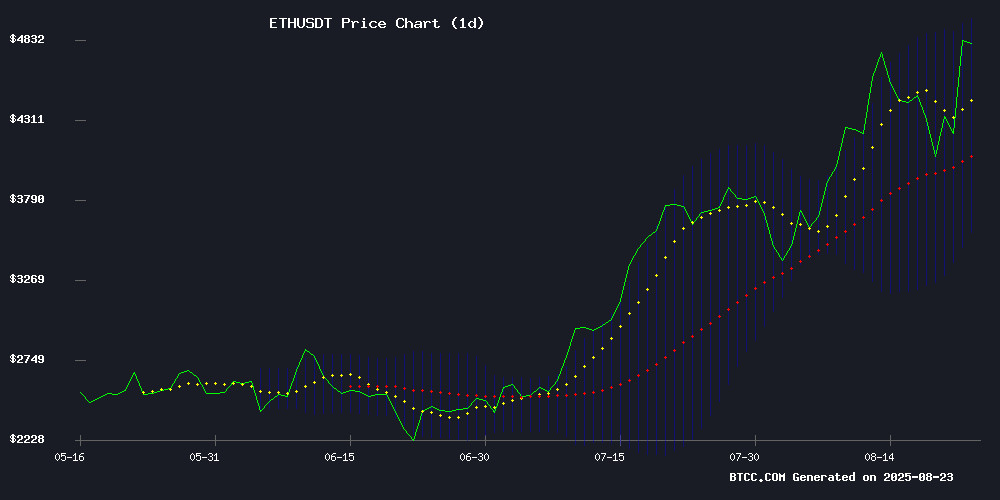

- Technical Breakout Potential: ETH is testing upper Bollinger Band resistance at $4,958 with converging MACD suggesting momentum building

- Institutional Support: BlackRock accumulation and $1.5B ETH-backed buybacks provide substantial fundamental backing

- Macroeconomic Tailwinds: Fed rate cut speculation and Powell's dovish stance creating favorable conditions for risk assets

ETH Price Prediction

Technical Analysis: ETH Approaches Critical Resistance Level

ETH is currently trading at $4,742.89, significantly above its 20-day moving average of $4,270.80, indicating strong bullish momentum. The MACD remains negative at -8.34 but shows signs of convergence as the histogram narrows, suggesting potential momentum shift. Price is testing the upper Bollinger Band at $4,958.68, which serves as immediate resistance. According to BTCC financial analyst Mia, 'ETH needs sustained volume to break above the $4,958 resistance for a clear path to $5,000. Failure to break could see a retest of the $4,260 support zone.'

Market Sentiment: Institutional Accumulation Drives Optimism

Market sentiment remains overwhelmingly bullish as ethereum reaches new all-time highs fueled by institutional accumulation and favorable macroeconomic conditions. BlackRock's substantial purchases and the approval of $1.5 billion in share buybacks backed by ETH holdings demonstrate strong institutional confidence. Spot Ether ETFs have recorded $287.6 million in inflows after a four-day outflow streak, indicating renewed investor interest. BTCC financial analyst Mia notes, 'The combination of Fed rate cut speculation, Powell's dovish signals, and institutional backing creates a perfect storm for ETH's push toward $5,000. However, traders should monitor the $4,260 support level closely.'

Factors Influencing ETH's Price

SharpLink Approves $1.5 Billion Share Buyback to Close Gap with ETH NAV

SharpLink Gaming, a Minneapolis-based gaming firm, has authorized a $1.5 billion stock repurchase program. The move aims to capitalize on potential discrepancies between the company's stock price and the net asset value (NAV) of its ethereum (ETH) holdings. With 740,760 ETH in its treasury—valued at over $3 billion—SharpLink sees buybacks as a more accretive strategy than equity issuance when shares trade at or below NAV.

CEO Joseph Chalom emphasized the firm's disciplined capital markets approach, noting that issuing new equity could dilute ETH-per-share value under such conditions. The company has aggressively expanded its ETH reserves through registered offerings and at-the-market (ATM) fundraising, positioning itself as a notable institutional holder of the cryptocurrency.

Ethereum Hits All-Time High Amid Powell's Dovish Signals and Institutional Accumulation

Ethereum surged to a record $4,868, marking its first all-time high since November 2021, fueled by Federal Reserve Chair Jerome Powell's暗示鸽派立场的言论 at the Jackson Hole symposium. Powell's suggestion of potential rate cuts in September has injected Optimism into crypto markets.

The second-largest cryptocurrency has rallied over 100% since June, with institutional players and corporate treasuries accumulating nearly 3 million ETH. BitMine Immersion and SharpLink Gaming have emerged as notable accumulators, according to StrategicETHReserve.xyz data.

Technical patterns suggest further upside potential, with ETH forming a bullish pennant after breaching $4,800. The momentum follows $9 billion inflows into Ethereum ETFs, underscoring growing institutional adoption.

BlackRock Buy Pushes Ethereum All Time High as Price Nears $5K

Ethereum is once again capturing market attention as its price approaches a historic milestone. The cryptocurrency currently trades at $4,810.80, inching closer to its all-time high of $4,891.70. Institutional interest, notably from BlackRock, appears to be fueling this rally.

The surge reflects growing confidence in ETH's market position amid broader crypto adoption. Market observers note the $5,000 psychological barrier could trigger renewed volatility if breached.

Ethereum Price Eyes $4,260 Support Zone; Break Could Trigger Drop to $3,700

Ethereum's price trajectory hinges on the $4,260 support level, where approximately 690,000 ETH have accumulated. A breach of this zone could see the cryptocurrency slide toward $3,700, according to on-chain analyst Ali Martinez. Market participants are closely monitoring volume clusters and orderbook behavior for signs of weakness.

The second-largest cryptocurrency by market cap currently trades around $4,248, comfortably above the psychological $4,000 mark but well short of its spring high NEAR $4,800. Technical indicators suggest ETH is consolidating within a short-term descending channel, with volatility expected to increase in coming days.

Traders appear to be repositioning ahead of macroeconomic events, as evidenced by short-term swaps and exchange-flow data. The $4,260 level represents a critical battleground between bulls and bears, with its significance derived from on-chain supply concentration charts showing where wallets accumulated the most coins.

Ethereum Surges 13% on Fed Rate Cut Speculation

Ethereum (ETH) soared 13% to levels last seen in November 2021 after Federal Reserve Chair Jerome Powell hinted at potential 2025 rate cuts during his Jackson Hole speech. The cryptocurrency's sharp rebound reflects its sensitivity to macroeconomic policy shifts, with traders interpreting Powell's suggestion of a September rate reduction as bullish for risk assets.

The rally marks a dramatic reversal from April's 63% decline from 2024 highs. Ethereum's 4.7 beta coefficient indicates amplified moves relative to traditional markets—a volatility profile that attracted both momentum traders and macro-focused investors during Friday's surge.

Market participants now watch whether the Fed's monetary policy pivot can sustain crypto's momentum beyond this tactical bounce. Liquidity conditions remain the dominant narrative for digital assets, with Ethereum serving as the primary bellwether for altcoin sentiment.

Ethereum Nears All-Time High Amid Surging Market Interest

Ethereum stands just 1% shy of reclaiming its record price, with bullish momentum accelerating across crypto markets. The $50 gap to its historic peak has triggered intensified trading activity and social media speculation.

Analysts point to rising volumes and strengthening technical indicators as catalysts for the potential breakout. Market participants now await confirmation of whether ETH can definitively breach resistance levels and enter price discovery mode.

SharpLink Gaming Authorizes $1.5B Stock Buyback Backed by ETH Holdings

SharpLink Gaming, Inc., a prominent corporate holder of Ether and vocal advocate for ETH, has approved a $1.5 billion stock repurchase program. The MOVE is strategically timed to capitalize on periods when the company's share price trades below the net asset value (NAV) of its ETH holdings, which currently stand at 740,800 ETH valued at a NAV of 1.06.

Joseph Chalom, Co-CEO of SharpLink, emphasized the rationale behind the buyback: "When our stock trades at or below the NAV of our ETH holdings, issuing new equity becomes dilutive. Repurchasing shares is the accretive alternative." The program aims to enhance the ETH-per-share ratio while providing market support.

As the second-largest corporate treasury holder of Ether, SharpLink's decision underscores institutional confidence in ETH's long-term value proposition. The buyback signals a bullish stance on Ethereum's role in corporate balance sheets.

SharpLink Bets Big on Ethereum with $1.5B Stock Buyback to Boost ETH Per Share

SharpLink has unveiled a $1.5 billion stock repurchase program designed to capitalize on the perceived undervaluation of its Ethereum-heavy portfolio. The firm holds 740,800 ETH, worth approximately $3.14 billion, and plans to deepen its involvement in Ethereum through staking and ETH-denominated asset management.

Co-CEO Joseph Chalom framed the buyback as a tactical move to align market capitalization with Ether net asset value (NAV). "Our mission is to grow ETH-denominated shareholder value," he said, emphasizing the program’s flexibility to act when shares trade below NAV. The strategy aims to reduce supply and increase ETH-per-share metrics for remaining investors.

The initiative underscores SharpLink’s aggressive positioning as a major institutional player in the Ethereum ecosystem. Unlike conventional buybacks, this plan is explicitly tied to Ether accumulation, staking, and treasury growth—core pillars of the company’s business model.

Spot Ether ETFs Rebound with $287.6M Inflows After Four-Day Outflow Streak

US spot Ether ETFs snapped a four-day outflow streak with $287.6 million in inflows on Thursday, marking a sharp reversal from the $924 million exodus recorded between August 15-21. BlackRock's ETHA dominated the rebound, capturing 81% of net inflows during the recovery.

Holdings now approach $28 billion across 6.42 million ETH, representing nearly 6% of circulating supply. Institutional accumulation continues unabated, with corporate treasuries amassing 4.10 million ETH worth $17.66 billion—including SharpLink Gaming's recent $667 million purchase that elevated its reserves to 740,000 ETH.

Will ETH Price Hit 5000?

Based on current technical indicators and market sentiment, ETH has a strong probability of testing the $5,000 level in the near term. The price is currently at $4,742.89, just 5.4% away from the psychological $5,000 milestone. Technical analysis shows ETH trading above its 20-day MA with converging MACD signals, while fundamental factors include institutional accumulation through ETFs and corporate buybacks.

| Key Level | Price | Significance |

|---|---|---|

| Current Price | $4,742.89 | Testing upper Bollinger Band |

| Resistance | $4,958.68 | Upper Bollinger Band |

| Target | $5,000.00 | Psychological milestone |

| Support | $4,260.00 | Critical support zone |

BTCC financial analyst Mia emphasizes that 'breaking above $4,958 resistance with volume could trigger the final push to $5,000, though traders should remain cautious of potential pullbacks to the $4,260 support area.'